This is should be a prospective customer's number one call to action, e.g., requesting a quote or perusing your product catalog.

- About Us

- Access Control System | BioMetric Solution| Time Attendance

- Audio & Video Intercoms

- Blog

- Blogs

- Building Management System (BMS)

- CCTV Camera Installation in offices Abu Dhabi

- CCTV Security and Surveillance Solutions Abu Dhabi

- CMS Website Designing in Abu Dhabi

- Company Warehouses CCTV Camera installation in Abu Dhabi

- Contact us

- Corporate Website Designing in Abu Dhabi Dubai

- E-commerce Website Designing in Abu Dhabi

- ELV System & Solutions

- Fiber Splicing Abu Dhabi

- Fire Alarm Maintenance Abu Dhabi

- Frequently Asked Questions (FAQ)

- Gallery

- GATES BARRIERS & TURNSTILES

- Grocery Baqala and Hypermarket CCTV installation in Abu Dhabi

- Home Automation System

- Home page

- Home/ Villa CCTV Security Systems in Abu Dhabi

- Hotel and Mall CCTV Camera installation in Abu Dhabi UAE

- Inner Page: Order Digital Marketing Services

- Inner page: Pricing Page

- Inner page: Services

- Intrusion Detection System

- IT Annual Maintenance Contract | Abu Dhabi, UAE

- IT Contract Staffing Abu Dhabi Dubai UAE

- IT Office Setup & Relocation | Abu Dhabi, UAE

- IT On Call Services | Abu Dhabi, UAE

- IT On-Site Support | Abu Dhabi, UAE

- IT Out-Staffing | Abu Dhabi, UAE

- IT Outsourcing And Temporary Staffing in Abu Dhabi UAE

- IT Recruitment Agency Abu Dhabi Dubai UAE

- IT Staffing Solution Abu Dhabi Dubai UAE

- IT Support | IT Company | Abu Dhabi, UAE

- IT Support and Services

- IT Technicians Manpower Supply

- IT Temporary Staffing Abu Dhabi Dubai UAE

- Medical Clinics and Hospital CCTV Camera installation in Abu Dhabi

- Nanny CCTV Camera Installation in Abu Dhabi

- Network Fluke Testing Company

- News & Media

- Outdoor CCTV Security Camera Installation Abu Dhabi

- Portfolio

- Retail Shop and Corporate Offices CCTV Camera Installation in Abu Dhabi

- Section: Blog

- Section: Case Studies

- Section: Clients

- Section: Marketing Resources

- Section: Testimonials

- Services

- Services: Affiliate Management

- Services: Company online presence analysis and audit

- Services: Conversion Rate Optimization (CRO)

- Services: Digital Consultancy

- Services: Dynamic Website Designing in Abu Dhabi

- Services: Email Marketing

- Services: Local SEO

- Services: Mobile Marketing

- Services: Pay Per Click Management (PPC)

- Services: Reputation Management

- Services: Search Engine Optimization

- Services: Social Media Marketing

- Services: Static Website Designing in Abu Dhabi

- Services: Web Design

- Services: Web Development

- SMATV Installation

- Structured Cabling Company

- Website Designing and Development

- WordPress Website Designing in Abu Dhabi

- Home

- About

- Services

- Web DevelopmentWeb Design & Development Solutions

- IT Support and Services UAEHardware & Software Trouble Shooting, Server maintenance, Data Recovery, Networking, Home PC Support, CCTV Camera, Telecom

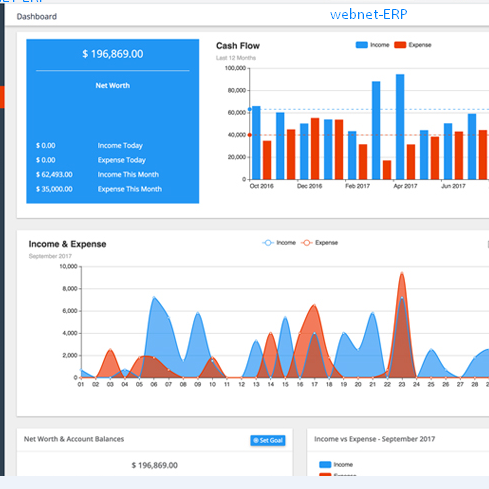

- ERP Business Software Solution (VAT) implementationVAT Solution For Small, Medium & Large Business in Abu Dhabi Dubai- UAE

- ERP VAT SolutionCustomers, Supplier, Inventory & Accounts Complete VAT Implementation

- Business ERP SolutionCRM, HRMS, ERP, SAP, Warehouses, Real Estate,Education,Project Management, Multiple Business Branches, Payroll etc.

- Retail SolutionPoint Of Sale (POS) , Restaurant Management , Pharmacy Management , Hotel Management etc.

- WEB NET TECHNOLOGIESWe have a strategy, experience and a proven track record in Abu Dhabi, Dubai & UAE, Providing Complete Solution of IT, ERP, Website Designing And Online Marketing

- IT Solutions

- ELV Solutions

- Blog

- Contact

- Home

- About

- Services

- Web DevelopmentWeb Design & Development Solutions

- IT Support and Services UAEHardware & Software Trouble Shooting, Server maintenance, Data Recovery, Networking, Home PC Support, CCTV Camera, Telecom

- ERP Business Software Solution (VAT) implementationVAT Solution For Small, Medium & Large Business in Abu Dhabi Dubai- UAE

- ERP VAT SolutionCustomers, Supplier, Inventory & Accounts Complete VAT Implementation

- Business ERP SolutionCRM, HRMS, ERP, SAP, Warehouses, Real Estate,Education,Project Management, Multiple Business Branches, Payroll etc.

- Retail SolutionPoint Of Sale (POS) , Restaurant Management , Pharmacy Management , Hotel Management etc.

- WEB NET TECHNOLOGIESWe have a strategy, experience and a proven track record in Abu Dhabi, Dubai & UAE, Providing Complete Solution of IT, ERP, Website Designing And Online Marketing

- IT Solutions

- ELV Solutions

- Blog

- Contact

is your accounting software UAE ERP VAT enabled

Our Services

Get the UAE vat diagram. UAE vat will be effected starting with 1 st january 2018. It UAE vat rate will be 5%. UAE vat will blanket every one results and benefits. Benefits of the business ought to think about those information Furthermore yield Tax, zero Rated expense Also exemptedtransactions. UAE vat Enlistment may be liable with begins In the wind from claiming Q3. One assembly enrollment might be accomplished for those organizations subjected of the states. Record keeping will be obligatorily for no less than 5 A long time. Taxpayers must record vat inside 28 days from those conclusion of the duty time. Punishments will be forced for non-compliance.

Vat is expected on the merchandise Furthermore administrations obtained from abroad.

UAE vat faq [Source: service for Finance, UAE ]. The point when will the vat try under impact and the thing that will be those rates?.

Vat will a chance to be acquainted over those UAE around 1 january 2018 at An standard rate of 5%.

Will vat blanket constantly on results What's more administrations?.

VAT, Similarly as An general utilization tax, will apply of the greater part about transactions of merchandise Also benefits unless particularly exempted or excepted Toward law.

The thing that parts will make zero rated?. Vat will make accused at 0% in regard of the Emulating fundamental classifications about supplies:. Fares of merchandise and benefits will outside those GCC;. Universal transportation, What's more related supplies;. Supplies about certain sea, air Furthermore territory method for transportation (such as aircrafts What's more. Ships);. Sure venture review precious metals (e. G. Gold, silver, for 99% purity);. Recently constructed private properties, that would supplied to the 1st the long run inside 3. A considerable length of time from claiming their development ;. Supply about specific instruction services, What's more supply of applicable products Also administrations;. Supply for specific social insurance services, and supply for applicable merchandise What's more administrations.

What parts will a chance to be exempt?. Those Emulating classifications from claiming supplies will a chance to be absolved from VAT:. The supply of exactly money related administrations (clarified for vat legislation);. Private properties;. Uncovered land; What's more. Neighborhood passementerie transport. Who could or will have the capacity on enroll for VAT?. A business must enroll for vat On their taxaceae supplies and imports surpass the obligatorily Enlistment edge from claiming AED 375,000. Furthermore, An benefits of the business might pick with enroll for vat voluntarily if their supplies Furthermore imports need aid under the obligatorily Enlistment threshold, in any case surpass those voluntary enrollment edge from claiming AED 187,500. Similarly, a benefits of the business might register voluntarily On their costs surpass the voluntary Enlistment edge. This last good fortune on register voluntarily will be outlined with empower start-up organizations with no turnover will enroll for vat.

What would the VAT-related responsibilities about businesses?. All organizations in the UAE will compelling reason will record their money related transactions and guarantee that their money related records need aid exact Also up to date. VAT-registered organizations generally:.

Must charge vat ahead taxaceae merchandise or benefits they supply;. Might recover At whatever vat they’ve paid on business-related merchandise alternately administrations;. Keep a range for benefits of the business records which will permit those legislature to weigh that they have got things right. Whether you’re An VAT-registered benefits of the business you must report card the measure for vat you’ve accused and the amount about vat you’ve paid of the legislature looking into a standard foundation. It will a chance to be An formal docility and it is probable that those reporting weight will a chance to be made web. On you’ve charged All the more vat over you’ve paid, you must pay the Contrast of the administration. Whether you’ve paid more vat over you’ve charged, you might recover the Contrast.

The thing that does An benefits of the business have on do to get ready for VAT?. Worried organizations will need the long haul on get ready When vat will come into impact to january 2018. Throughout that time, organizations will compelling reason on meet necessities on satisfy their duty commitments. Organizations Might start presently with the goal that they will make primed later. With fully consent for VAT, we think that organizations might requirement with settle on a portion transforms should their center operations, their money related administration What's more book-keeping, their technology, Furthermore maybe considerably their mankind's asset blend (e. G. , bookkeepers and duty advisors). It will be key that organizations attempt with get it those suggestions for vat currently Furthermore once those enactment will be issued settle on each exert with adjust their business model to legislature reporting weight Also consistence necessities. We will provide organizations with direction for how to completely consent for vat once those enactment is issued. Those last obligation What's more responsibility on go along for law will be on the benefits of the business.

The point when need aid organizations assumed on start registering to VAT?. Vat will come into energy around 1 january 2018. Whatever benefits of the business that is obliged on be enlisted for vat Also accuse vat starting with 1 january 2018 must a chance to be enlisted former to that date.

O empower organizations with get ready to presentation from claiming vat and consent with this Enlistment commitment for time, those electronic registrations will a chance to be open for vat starting with those third quarter about 2017 with respect to An voluntary groundwork Also a necessary premise starting with the last quarter about 2017 for the individuals that choosenot with register sooner. This will guarantee that there will be no a minute ago surge starting with organizations to enroll for vat When those due date.

The point when would enlisted organizations needed should record vat returns?. Taxpayers must record vat returns with the FTA ahead An general support (quarterly or for a shorter period, ought to the FTA choose so) inside 28 times from those wind of the duty period over understanding for those methods specified in the vat enactment. Those assessment returns might make documented internet utilizing eServices.

The thing that sort of records need aid organizations obliged will maintain, What's more to how long?Businesses will make needed with keep records which will empower the national duty power to recognize those points of the benefits of the business exercises and survey transactions. Those specifics viewing those documents which will make obliged and the time period for keeping them will a chance to be stated in the important enactment.

To what extent must a taxaceae persnickety hold vat receipts for?. Whatever taxaceae individual must hold vat receipts issued What's more gained for a base from claiming 5 quite some time.

The thing that would the situations that might prompt the inconvenience about penalties?. Punishments will a chance to be forced for non-compliance.

Samples of activities and omissions that might provide for raise with punishments include:.

An individual neglecting on register when needed with would so;. An individual fizzling on submit an assessment exchange alternately settle on a installment inside the obliged period;. An individual fizzling on keep those records needed under the issued expense legislation;. Charge avoidance offences the place an individual performs a planned enactment or oversight for the proposition about disregarding those procurements of the issued assessment enactment.

How rapidly will refunds a chance to be released?. Refunds will make produced after those receipt of the requisition What's more subject with confirmation checks, for a specific concentrate on avoiding duplicity.

Will it make could be allowed to issue money receipts As opposed to vat invoices?. An supplier enlisted alternately required to a chance to be enlisted to vat must issue a substantial vat receipt to those supply. On a chance to be acknowledged Concerning illustration a substantial vat invoice, the record must take after a particular organization as said in the enactment. For specific circumstances the supplier might have the capacity to issue An rearranged vat receipt. The states for the vat receipt and the rearranged vat receipt need aid specified enactment.

Will vat make paid with respect to imports?. Vat is expected on the merchandise Furthermore administrations obtained from abroad. In the event that those beneficiary in the state will be an enlisted man for those elected charge power to vat purposes, vat might be expected on that import utilizing An reverse charge system. In the event those beneficiary in the state may be An non-registered persnickety to vat purposes, vat might a chance to be paid ahead import about products starting with An put outside those GCC. Such vat will regularly a chance to be needed should make paid in front of the merchandise need aid discharged of the persnickety.

Will organizations must report card ahead their business over every of the Emirates?.

It will be anticipated that organizations will compelling reason with finish extra majority of the data for their vat returns to report card incomes earned over each emirate. Direction will a chance to be Gave on organizations for respects to this. It is anticipated that those tenets will be generally clear for the vast majority organizations Also will be based, to example, to B2C transactions, on the area of the transaction (e. G. For a retail environment, the area of the shop).

Accounting ERP Software UAE

Webnet-ERP

Retail VAT enabled Software UAE

Retail VAT Enabled

Inventory ERP VAT software UAE

Industry-ERP

Next Steps...

Webnetech is one of the fastest growing Software Company in UAE. We aim to provide ease and automation in every business area. Tell us about your desire and we are ready for 24/7 to serve you.

Quick Links

Digital Marketing UAE

Mobile Development UAE